Context

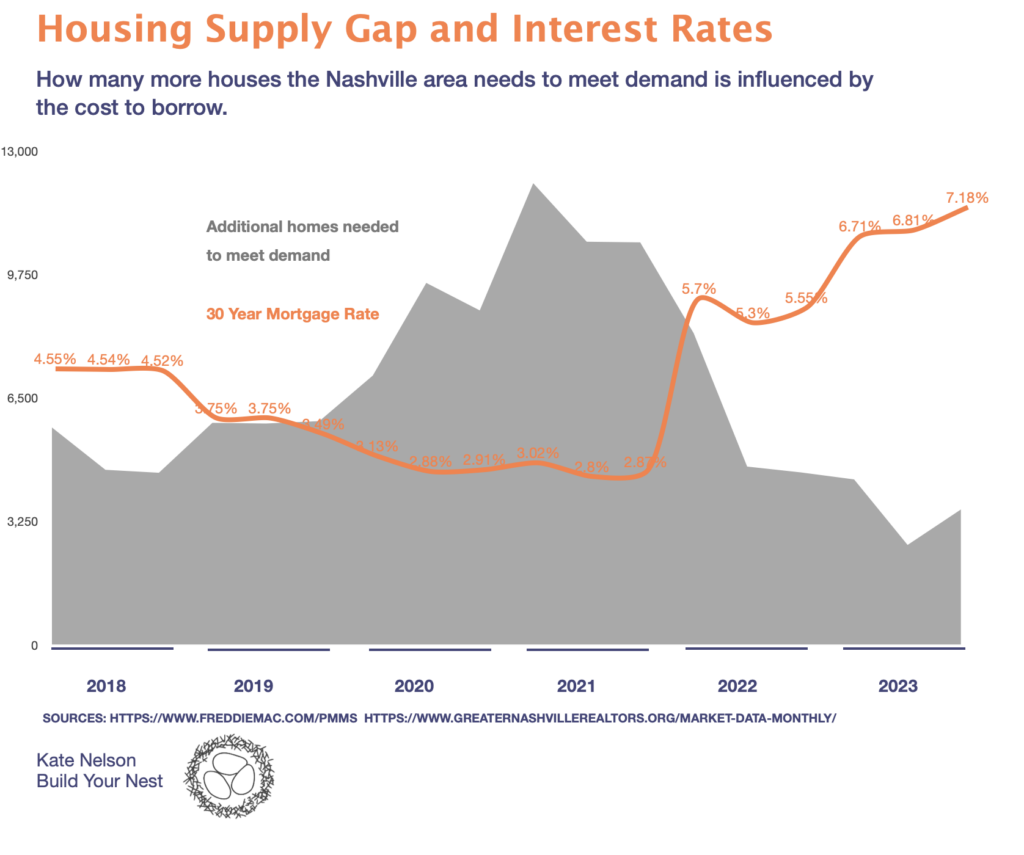

Extremely low interest rates in 2020 and 2021 led to an enormous gap between how many homes our market could absorb and how many were for sale.

While new construction has not been able to keep up with population growth in Middle Tennessee for quite some time, the huge difference between how many Buyers were trying to buy and how many homes were available was unprecedented.

As the Fed lowered their interest rate to help our economy through the early days of the covid pandemic, they raised their interest rate over the past eighteen months to fight inflation. Rising fed rates have led to steep mortgage rate increases.

Rising Rates Impact Supply

Over the summers of 2022 and 2023, the gap between how many houses were for sale and how many houses the market could absorb shrank.

As fixed interest rates rose into the 5s up to the 7s, many Buyers lowered their budgets or left the market. At the same time, many homeowners were disincentivized to sell if it meant their new homes would come with much more expensive mortgages than their current homes.

Buyers and Sellers

Since the spring of 2022 I have seen Buyers gain more negotiating power with concessions such as closing cost credits, interest rate buy-downs, and repairs.

Sellers have had to be more aware of their home’s presentation and the value they are offering, while also being more willing to compromise with Buyers.

With rates still in the 7s this fall, I anticipate increasing opportunities for Buyers.